Crowdfunding Platforms – Foresight for Business Model Innovation

2014

As we continuously seek to make sense of the world around us, seeking patterns that might indicate something, the one most frequent source we rely on is trends. In the world of technology, not a day goes by without some article or post on trends.

I came across this interesting post on the trends to follow in the coming year. The post suggests that funding patterns for successful projects on Kickstarter provide guidance on trends to follow.

The chart below shows the 100 most successful projects – The analysts (at SimplyZesty) used various measures such as total value of pledges, average pledge size, number of pledges received and so on (see original post for more details).

Categories of 100 most successful technology projects

Fig 1: 100 most successful technology projects on Kisckstarter

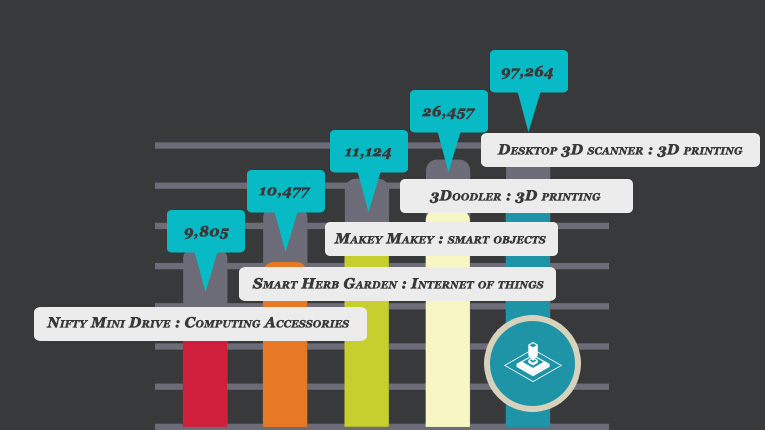

The following chart shows the projects with the highest number of individual backers.

Most backed projects

Fig 2: Top five projects with the highest number of individual backers

People who fund projects on Kickstarter are a combination of entrepreneurs and consumers. They like a product idea, understand the risk that even though they have seen some evidence, the idea might eventually not make it or work.

Some of the projects on Kickstarter are there because conventional methods of raising money did not work, and others because they consciously chose this crowdsourced funding channel.

In any case, the people that fund these projects are pioneers or early adopters in marketing parlance. If we trust their judgment, and we have to look at this information somewhat differently from the situation than if these graphs had showed projects that had received funding through formal financing channels such as VCs.

The questions this analysis raises are: who then benefits from looking at this information and following these trends? What sort of action should one take as a result of this analysis? Is this a test for the formal financiers to step in? As an individual, does this give me some confidence in investing in upcoming firms? Should these trends be triggers for examining how something might impact a business model that you are invested in?

The answer is of course yes, depending on what your interests are. The key insight is that indirect sources such as Kickstarter and other similar crowdfunding platforms are crucibles for emerging interests and an important new resource for developing foresight, understanding implications for business models and anticipating opportunities for disruptive innovation.